Integrating an accounting system

This page is under construction.

Handling events

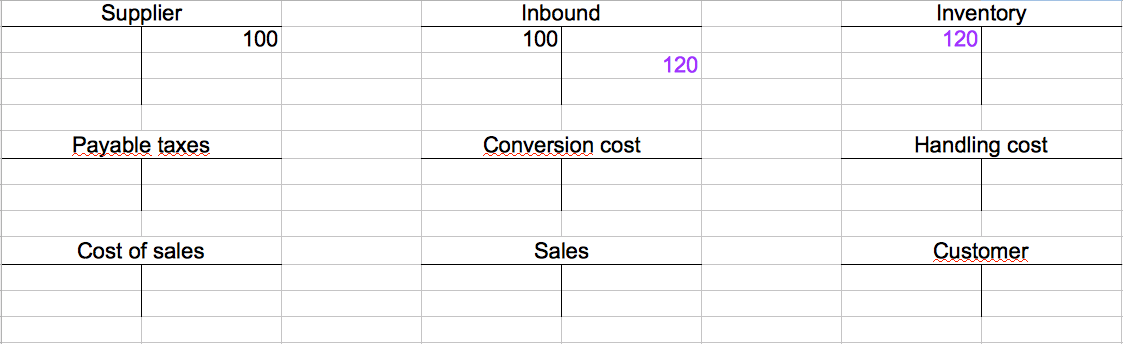

Goods receipt created

The event is described here. The relevant events will have document type equal to ‘GOODS_RECEIPT’.

We assume that you have an account for inbound shipments. This account is debited when the shipment is delivered.

When the shipment has been received, you should credit the account for inbound shipments and debit the inventory account.

In this example 10 pieces at standard cost price 12 are received.

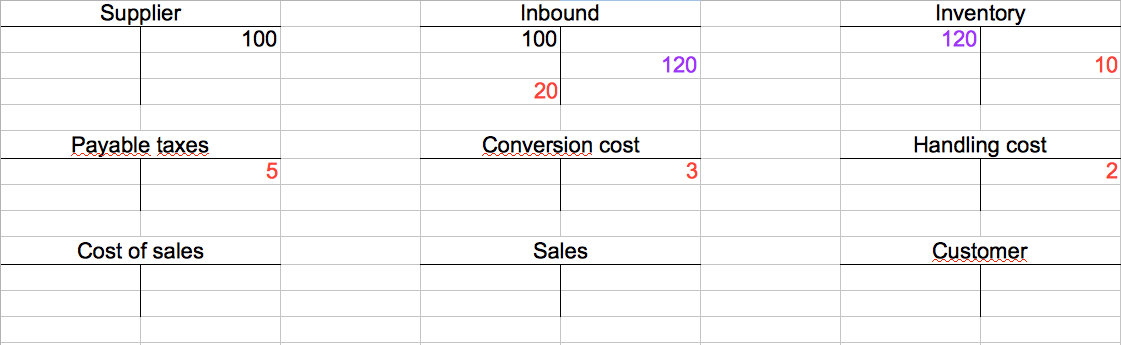

Cost variance list created

The event is described here. The relevant events will have document type equal to ‘COST_VARIANCE_LIST’.

When all costs have been registered and the shipment has been recalculated, you should adjust the inventory account accordingly. The difference should be booked against an account for acquisition costs.

In this example taxes of 5, handling cost of 2 and conversion cost of 3 has been registered. Hence, a cost variance of 10 is calculated. The cost price is now 11.

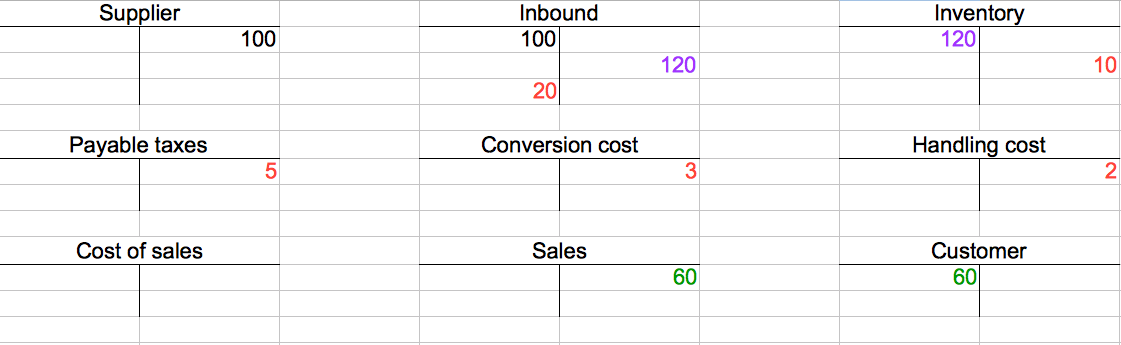

Delivery note created

The event is described here. The relevant events will have document type equal to ‘DELIVERY_NOTE’.

When a delivery note has been created you may want to invoice the customer. This is usually what you want to do when the customer is a business and the delivery terms are ex work.

In this example 3 pieces are sold at 20 each.

Consignment note created

The event is described here. The relevant events will have document type equal to ‘CONSIGNMENT_NOTE’.

When a consignment note has been created you may want to invoice your customers. This is usually what you want to do when the customer is a consumer.

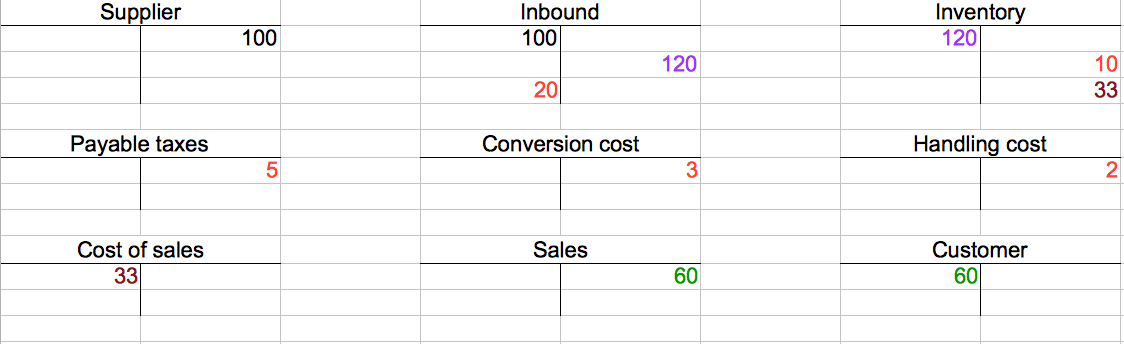

Cost of sales list created

The event is described here. The relevant events will have document type equal to ‘COST_OF_SALES_LIST’.

When a cost of sales list is created you want to credit the inventory account and debit you cost of sales account.

In this example the cost of the 3 pieces sold above are booked.

Adjustment list created

……